Are you planning to take out a loan but don’t know where to start? Getting approved for a loan can be a daunting task, especially if you’re new to the process. But fear not. With the right knowledge and preparation, you can increase your chances of getting approved for the loan that best fits your needs. Here, we’ll guide you through some essential steps on how to get approved for a loan successfully. From choosing the right type of loan to finding the perfect lender and organizing your documents correctly, we’ve got you covered. So let’s dive in and learn how to make your next loan application stress-free and successful.

Choose the Right Loan for You

Choosing the right loan is crucial to ensure you get approved and that it fits your financial needs. But with so many options available, how do you know which one to choose? Firstly, you need to determine why you’re taking out a loan. Is it for a large purchase like a car or house? Or are you looking for a personal loan to consolidate debt? Understanding your purpose will help narrow down your options. On the other hand, if you are looking for the best installment loans for bad credit, you should continue reading.

Find the Right Lender

Finding the right lender is a crucial step in getting approved for a loan. Each lender has its own set of requirements, interest rates, and terms and conditions that you need to consider before choosing one. Start by researching different lenders online or asking for recommendations from friends or family who have taken out loans before. Look at their reputation, reviews, and customer service quality. Next, compare each potential lender’s interest rates and fees to find the most affordable option that suits your needs. Be sure also to review their repayment options and any penalties associated with early payments or late payments.

Get Your Documents in Order

Approved for a loan requires more than choosing the right lender or loan type. You will need to have your documents in order to increase your chances of getting approved. Firstly, make sure you have all the necessary identification documents such as your driver’s license, passport, and social security card. Lenders will want to verify your identity before approving you for a loan. Secondly, gather proof of income such as pay stubs and tax returns. This helps lenders determine whether you can afford the payments on the loan. Thirdly, compile any other relevant financial information like bank statements or investment portfolios that may help show lenders that you are financially stable enough to repay the loan.

Approved for a loan requires more than choosing the right lender or loan type. You will need to have your documents in order to increase your chances of getting approved. Firstly, make sure you have all the necessary identification documents such as your driver’s license, passport, and social security card. Lenders will want to verify your identity before approving you for a loan. Secondly, gather proof of income such as pay stubs and tax returns. This helps lenders determine whether you can afford the payments on the loan. Thirdly, compile any other relevant financial information like bank statements or investment portfolios that may help show lenders that you are financially stable enough to repay the loan.

Getting approved for a loan can be a daunting task. However, following these simple steps of choosing the right loan for you, finding the right lender, and gathering all necessary documents will undoubtedly increase your chances of approval. Remember to always do your research before applying for any loans and understand the terms and conditions thoroughly. Take note of repayment periods and interest rates as well to ensure that you are comfortable with them. By doing so, you will improve your chances of getting approved and save yourself from potential financial stress down the road. So go forth equipped with this knowledge and make informed financial decisions today.…

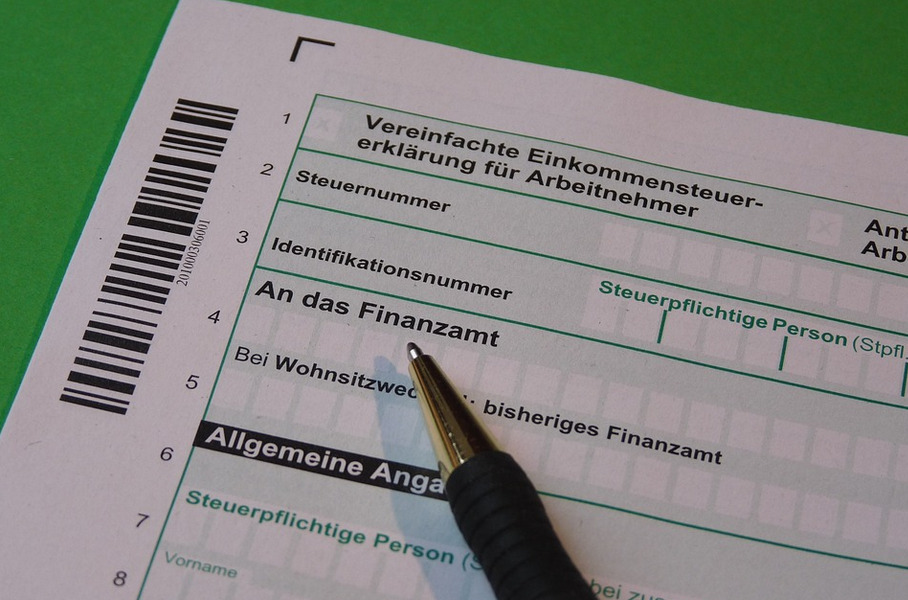

Tax preparation services do more than help you file your taxes – they can also save you a lot of time. By having an experienced team take care of the entire process, you won’t have to worry about getting everything done independently. Plus, the experts at these services are familiar with the latest tax laws, so they can ensure that you get the most out of your return.

Tax preparation services do more than help you file your taxes – they can also save you a lot of time. By having an experienced team take care of the entire process, you won’t have to worry about getting everything done independently. Plus, the experts at these services are familiar with the latest tax laws, so they can ensure that you get the most out of your return. Tax preparation services are not just about filing taxes – they can also help you save money. Having a team of experts look over your finances can help identify deductions and credits that you may not have been aware of.

Tax preparation services are not just about filing taxes – they can also help you save money. Having a team of experts look over your finances can help identify deductions and credits that you may not have been aware of. Another great benefit of hiring a tax preparation service is that they are experienced in the complexities of tax laws and regulations. This means that they know exactly what needs to be done when filing your taxes and can ensure that everything is done correctly and efficiently.

Another great benefit of hiring a tax preparation service is that they are experienced in the complexities of tax laws and regulations. This means that they know exactly what needs to be done when filing your taxes and can ensure that everything is done correctly and efficiently.

One reason to consider a balloon payment is to save money on interest payments. With a traditional loan, you must make monthly payments over the loan term – with each month’s installment carrying interest charges. A balloon payment allows you to avoid these interest charges by making one large payment at the end of your loan term. People who have just known about the concept often find it strange, but this is an effective way to save money. Which is why it is gaining more popularity.

One reason to consider a balloon payment is to save money on interest payments. With a traditional loan, you must make monthly payments over the loan term – with each month’s installment carrying interest charges. A balloon payment allows you to avoid these interest charges by making one large payment at the end of your loan term. People who have just known about the concept often find it strange, but this is an effective way to save money. Which is why it is gaining more popularity. Another reason to consider a balloon payment is that it can make your payments much more manageable. By making one large payment at the end of the loan term, you’ll be able to reduce your monthly payments and free up some extra cash each month. This could come in handy if you have other expenses or need extra funds for an emergency situation. In fact, some car loans even offer a lower interest rate when you choose to make a balloon payment. But depending on the company, it is best to compare different offers to ensure you’re getting the best deal. This is what many people are doing.

Another reason to consider a balloon payment is that it can make your payments much more manageable. By making one large payment at the end of the loan term, you’ll be able to reduce your monthly payments and free up some extra cash each month. This could come in handy if you have other expenses or need extra funds for an emergency situation. In fact, some car loans even offer a lower interest rate when you choose to make a balloon payment. But depending on the company, it is best to compare different offers to ensure you’re getting the best deal. This is what many people are doing. The last reason to consider a balloon payment is to build your credit score. When you make timely payments on a loan, it reflects positively on your credit score. If you can pay off the entire loan with a balloon payment at once, this can help boost your credit rating even further. Many banks and lending institutions use credit scores to decide whether or not to lend money, so it’s worth looking into. So, balloon payments can be a great option if you are looking for a way to build your credit score.

The last reason to consider a balloon payment is to build your credit score. When you make timely payments on a loan, it reflects positively on your credit score. If you can pay off the entire loan with a balloon payment at once, this can help boost your credit rating even further. Many banks and lending institutions use credit scores to decide whether or not to lend money, so it’s worth looking into. So, balloon payments can be a great option if you are looking for a way to build your credit score.

Another way to avoid credit card debt is to keep track of your spending. This means knowing how much money you have coming in and going out each month. It also means tracking your expenses to see where your money is going. When you know where your money is going, you can make adjustments to ensure that you’re not spending more than you can afford. It has been proven that people who keep track of their spending are less likely to get into debt.

Another way to avoid credit card debt is to keep track of your spending. This means knowing how much money you have coming in and going out each month. It also means tracking your expenses to see where your money is going. When you know where your money is going, you can make adjustments to ensure that you’re not spending more than you can afford. It has been proven that people who keep track of their spending are less likely to get into debt.

One of the first things that you need to do if you want to be financially independent is to fix any credit problems that you may have. If your credit score is low, it will be difficult for you to get loans or lines of credit.

One of the first things that you need to do if you want to be financially independent is to fix any credit problems that you may have. If your credit score is low, it will be difficult for you to get loans or lines of credit. Lastly, investing your money is another essential step if you want to be financially independent. When you invest, you are essentially putting your money into something that has the potential to grow over time.

Lastly, investing your money is another essential step if you want to be financially independent. When you invest, you are essentially putting your money into something that has the potential to grow over time.

Professional tax relief firms can prevent losing your property to IRS seizure. If you owe back taxes, the IRS has the right to seize your property, including your home or car.

Professional tax relief firms can prevent losing your property to IRS seizure. If you owe back taxes, the IRS has the right to seize your property, including your home or car. Another benefit of working with a professional tax relief firm is that they can help you prevent IRS wage garnishment. If you owe back taxes, the IRS has the right to take a portion of your paycheck each week to pay your debt. However, if you are working with a tax relief firm, they can negotiate with the IRS on your behalf and help you keep your entire paycheck.

Another benefit of working with a professional tax relief firm is that they can help you prevent IRS wage garnishment. If you owe back taxes, the IRS has the right to take a portion of your paycheck each week to pay your debt. However, if you are working with a tax relief firm, they can negotiate with the IRS on your behalf and help you keep your entire paycheck.